Recent extremely meaningful negative changes in investment behavior have impacted BlueLinx Holdings Inc (NYSE: BXC): its longer term price trend turned down, its shorter term price trend turned down, and negative upside/downside volume developed.

BlueLinx Holdings Inc (NYSE: BXC) has recently experienced marginal negative changes in fundamentals: significant quarterly earnings deceleration occurred.

In light of these highly negative signals we are reviewing our current Overall Rating of D. We would continue to view the shares with caution pending completion of this review in the next several days.

Current PriceTarget Research Rating

BXC’s future returns on capital are forecasted to exceed the cost of capital. Accordingly, the company is expected to continue to be a Value Builder.

BlueLinx Holdings has a current Value Trend Rating of D (Negative). This rating combines contradictory signals from two proprietary PTR measures of a stock’s attractiveness. BlueLinx Holdings has a slightly positive Appreciation Score of 63 but a poor Power Rating of 21, triggering the Negative Value Trend Rating.

Recent Price Action

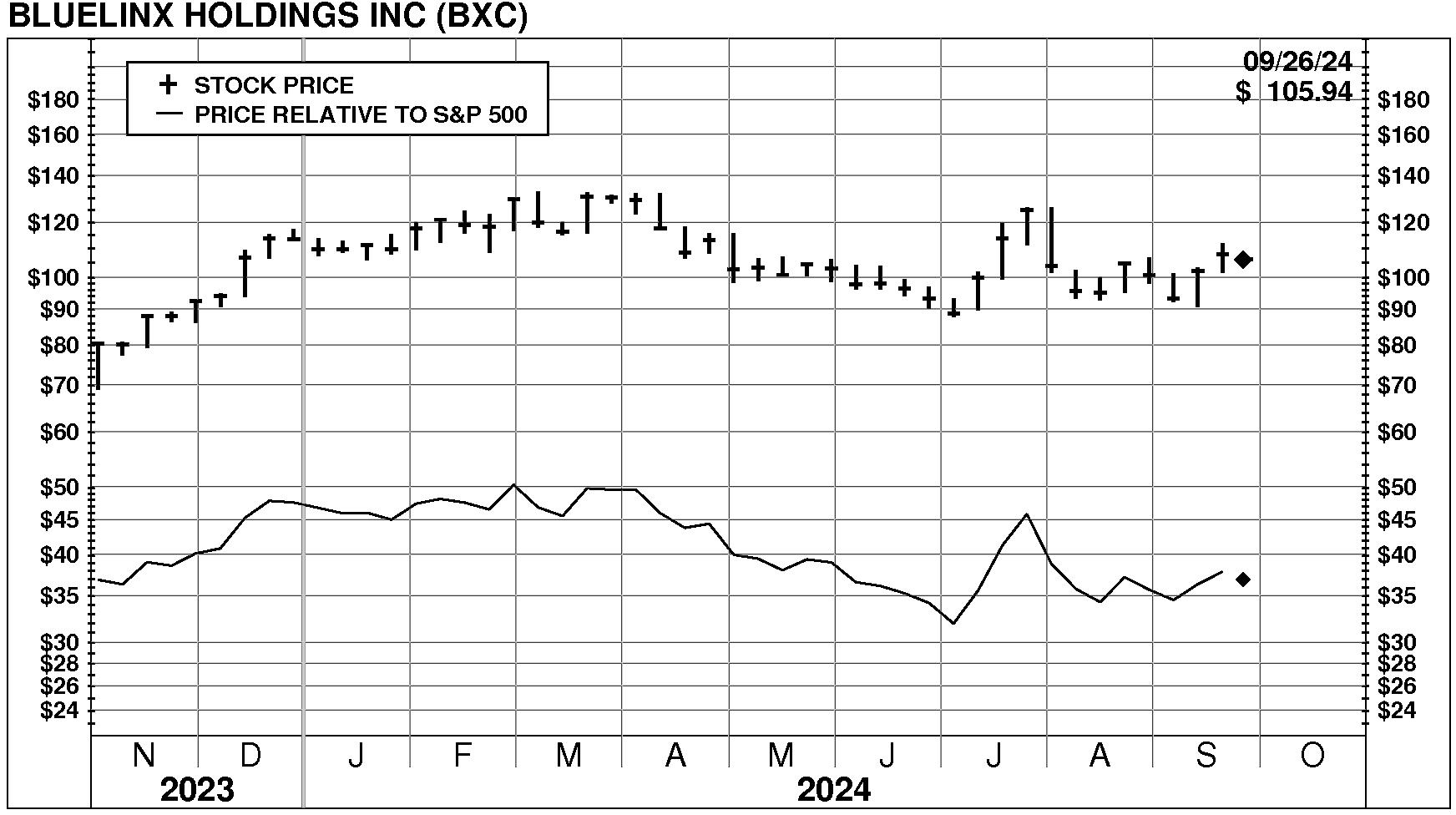

On 9/26/24, BlueLinx Holdings Inc (NYSE: BXC) stock enjoyed a large increase of 2.8%, closing at $105.94. However, below average trading volume at 79% of normal accompanied the advance. Relative to the market the stock has been weak over the last nine months and is unchanged during the last week.

Be the first to comment