For its second fiscal quarter (ending June 30), Manhattan Bridge Capital (NASDAQ: LOAN) has reported a 0% change in E.P.S. from $0.12 a year ago to $0.12 in the current quarter. This result was in line with the consensus estimate of $0.12. For the latest four quarters through June 30, E.P.S. were $0.50 versus $0.44 for the same period a year ago — an increase of 14%.

Recent Price Action

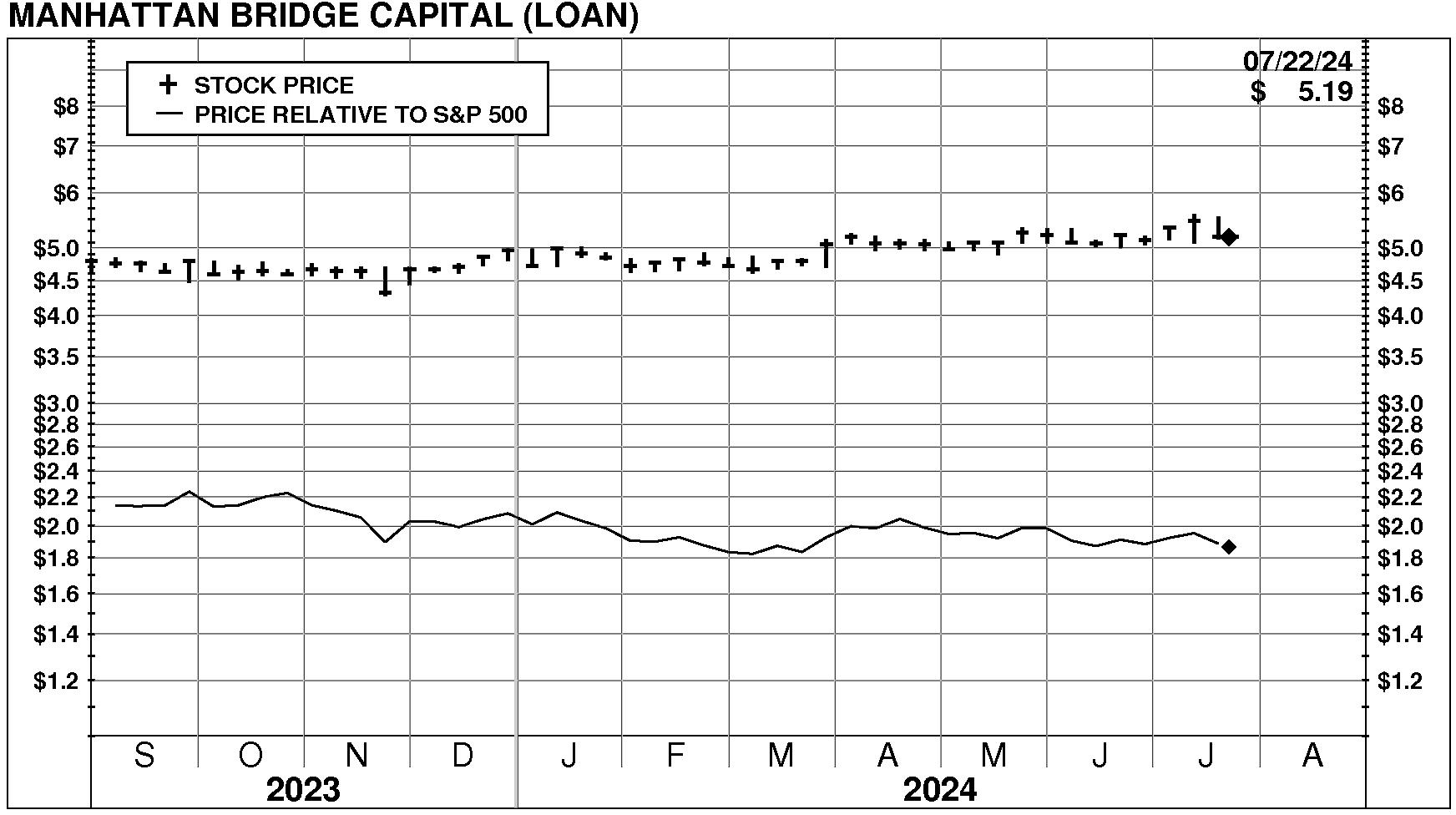

Manhattan Bridge Capital (NASDAQ: LOAN) stock was unchanged 0.0% on 7/22/24. The shares closed at $5.19. However, this flat performance was accompanied by exceptionally low trading volume at 32% of normal. The stock has been strong relative to the market over the last nine months but has declined -5.3% during the last week.

Current PriceTarget Research Rating

With future capital returns forecasted to be above the cost of capital, LOAN is expected to continue to be a Value Builder.

Manhattan Bridge Capital has a current Value Trend Rating of C (Low Neutral). With this rating, PTR’s two proprietary measures of a stock’s current attractiveness are providing consistent signals. Manhattan Bridge Capital has a slightly negative Appreciation Score of 36 and a neutral Power Rating of 55, with the Low Neutral Value Trend Rating the result.

Rating Review

In light of this new information we are reviewing our current Overall Rating of C. This review will be completed in the next several days.

Be the first to comment