Stock Rating Upgrade

Reflecting improving fundamentals and high Appreciation Potential, the Value Trend Rating for Chesapeake Utilities Corp. (NYSE: CPK) improved recently. CPK’s current Value Trend Rating is C and the prior Rating was D. Details supporting this higher rating are included in our next report.

Recent Price Action

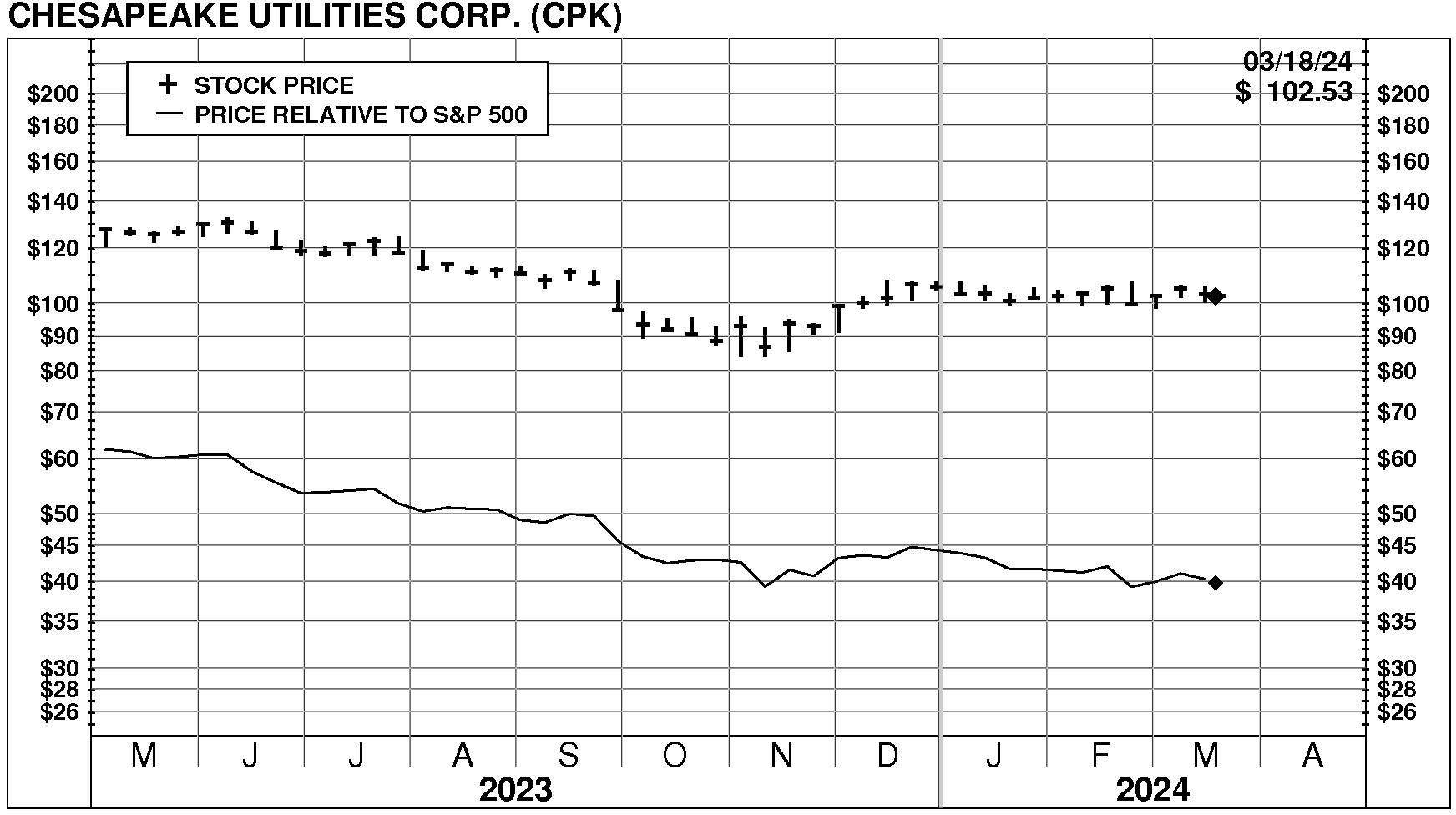

On 3/18/24, Chesapeake Utilities Corp. (NYSE: CPK) stock declined slightly by -0.5%, closing at $102.53. However, trading volume in this decline was unusually low at 62% of normal. The stock has been weak relative to the market over the last nine months and has declined -2.4% during the last week.

Current PriceTarget Research Rating

With future capital returns forecasted to be above the cost of capital, CPK is expected to continue to be a Value Builder.

Chesapeake Utilities has a current Value Trend Rating of C (Low Neutral). This VT Rating improved in recent days from D previously. The Value Trend Rating reflects highly consistent signals from PTR’s two proprietary measures of a stock’s attractiveness. Chesapeake Utilities has a neutral Appreciation Score of 49 and a neutral Power Rating of 41, with the Low Neutral Value Trend Rating the result.

Be the first to comment