Stock Rating Upgrade

Reflecting improving fundamentals and high Appreciation Potential, the Value Trend Rating for Chesapeake Utilities Corp. (NYSE: CPK) improved in the last week. CPK’s current Value Trend Rating is B and the prior Rating was C. Details supporting this higher rating are included in our next report.

Recent Price Action

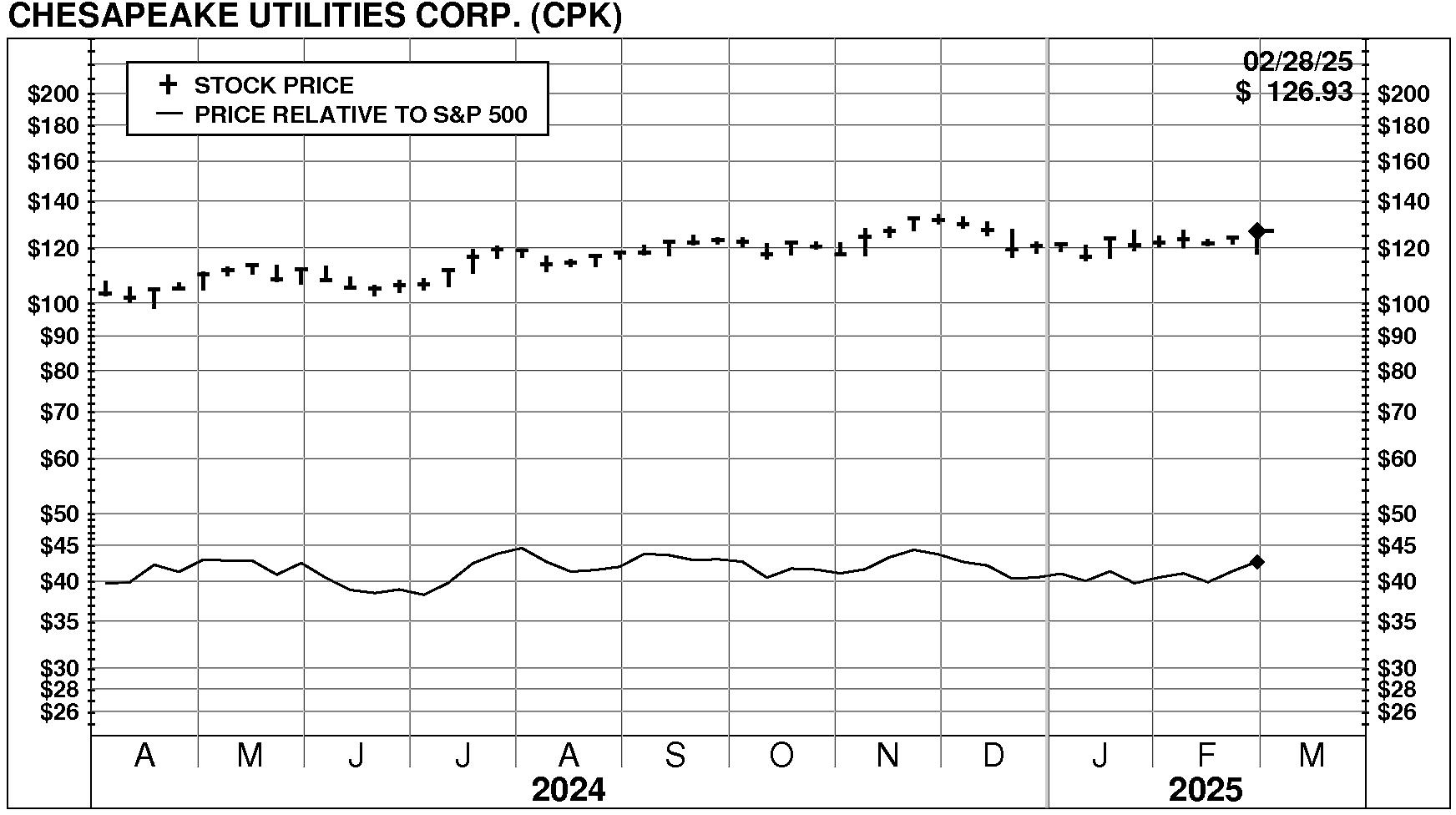

Chesapeake Utilities Corp. (NYSE: CPK) stock rose modestly by 0.4% on 2/28/25. The stock closed at $126.93. Moreover, trading volume in this advance was unusually high at 165% of normal. The stock has risen 2.7% during the last week and has been strong relative to the market over the last nine months.

Current PriceTarget Research Rating

Chesapeake Utilities has a current Value Trend Rating of B (Positive). This VT Rating improved in recent days from C previously. The Value Trend Rating reflects inconsistent signals from PTR’s two proprietary measures of a stock’s attractiveness. Chesapeake Utilities has a neutral Appreciation Score of 57 but a good Power Rating of 72, producing the Positive Value Trend Rating.

Be the first to comment