Newell Brands Inc (NASDAQ: NWL) has reported a loss for its fourth fiscal quarter (ending December 31) of $-0.13 versus a loss $-0.21 for the same period a year ago. This performance was $-0.27 short of the consensus estimate of $0.14. For the latest four quarters through December 31, E.P.S. were $-0.52 compared to $-0.94 a year ago.

Recent Price Action

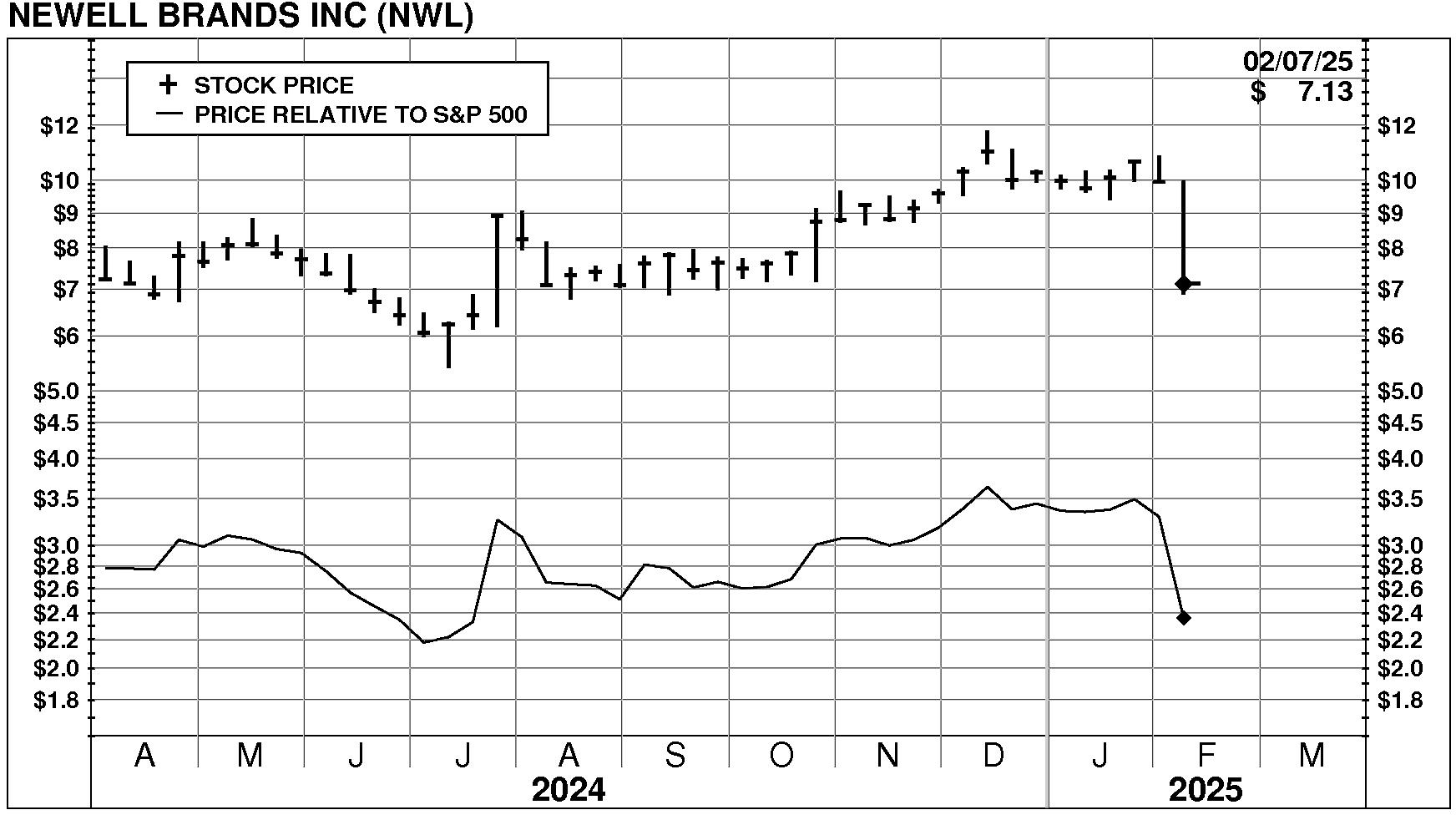

Newell Brands Inc (NASDAQ: NWL) stock closed at $7.13 on 2/7/25 after a major decline of -26.4%. Moreover, exceptionally high trading volume at 537% of normal accompanied the decline. Relative to the market the stock has been exceptionally strong over the last nine months but has declined -31.8% during the last week.

Current PriceTarget Research Rating

Newell Brands has a current Value Trend Rating of A (Highest Rating). The Value Trend Rating reflects complementary signals from PTR’s two proprietary measures of a stock’s attractiveness. Newell Brands has a slightly positive Appreciation Score of 64 and a very high Power Rating of 89, and the Highest Value Trend Rating results.

Rating Review

In light of this new information and highly negative price change we are reviewing our current Overall Rating of A. This review will be completed in the next several days.

Be the first to comment