Extremely important negative changes in investment behavior have recently occurred for AutoZone Inc (NYSE: AZO): negative upside/downside volume developed, and its shorter term price trend turned down.

AutoZone Inc (NYSE: AZO). Significant negative changes in fundamentals have recently occurred: the consensus estimate for August, 2025 decreased significantly, and the consensus estimate for August, 2026 decreased significantly.

The stock is currently unrated.

Current PriceTarget Research Rating

AZO is expected to be a major Value Eraser reflecting capital returns that are forecasted to fall short of the cost of capital.

AutoZone is currently unrated.

Recent Price Action

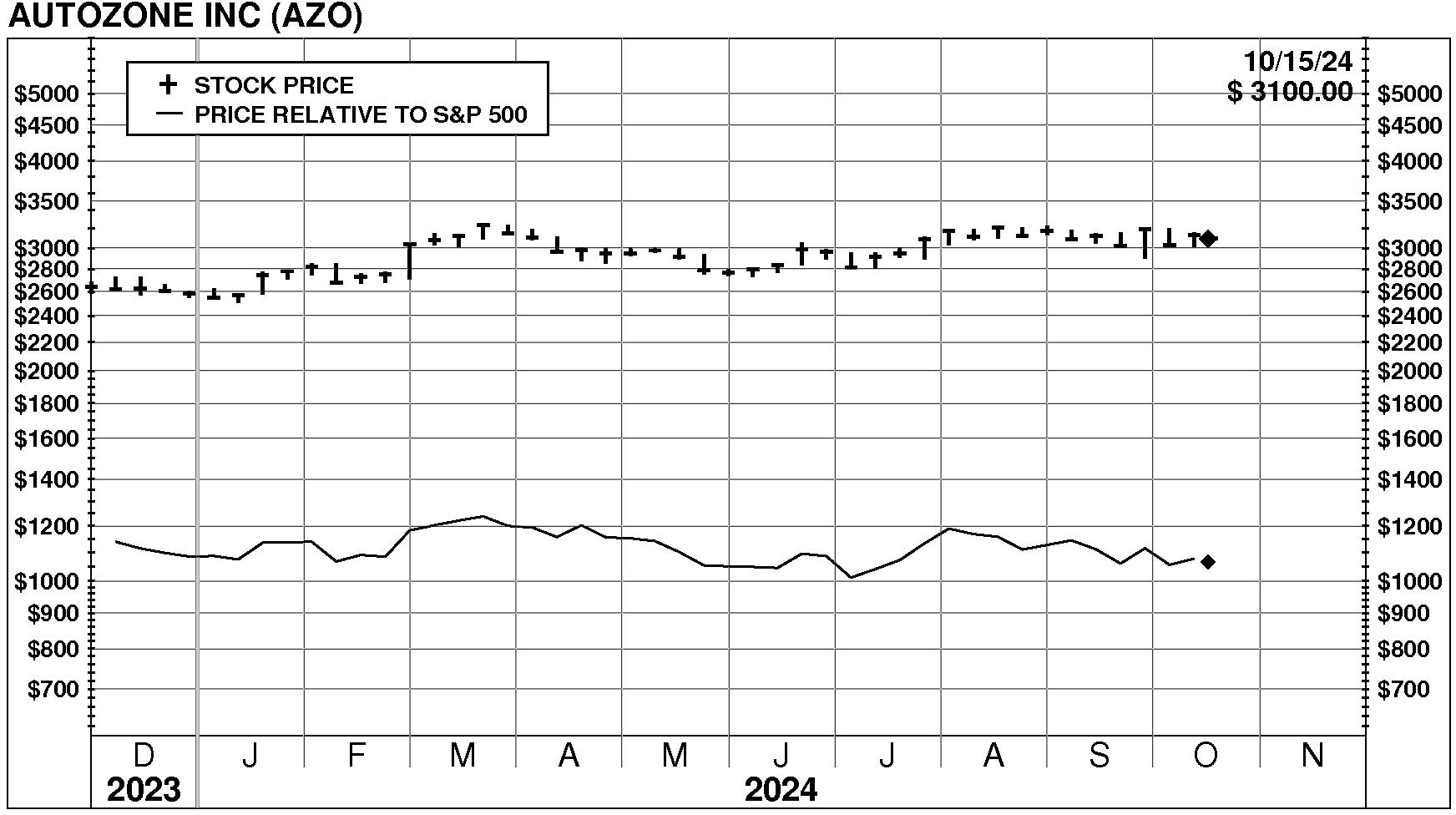

AutoZone Inc (NYSE: AZO) stock declined modestly by -1.7% on 10/15/24. The stock closed at $3100.00. Moreover, trading volume in this decline was unusually high at 159% of normal. Relative to the market the stock has been strong over the last nine months and has risen 1.5% during the last week.