For its second fiscal quarter (ending June 30), KeyCorp (NYSE: KEY) has reported a -7% decline in E.P.S. from $0.27 a year ago to $0.25 in the current quarter. However, this result exceeded the consensus estimate of $0.25 by $0.00. E.P.S. were $0.77 for the latest four quarters through June 30 versus $1.50 for the same period a year ago — a decline of -49%.

Recent Price Action

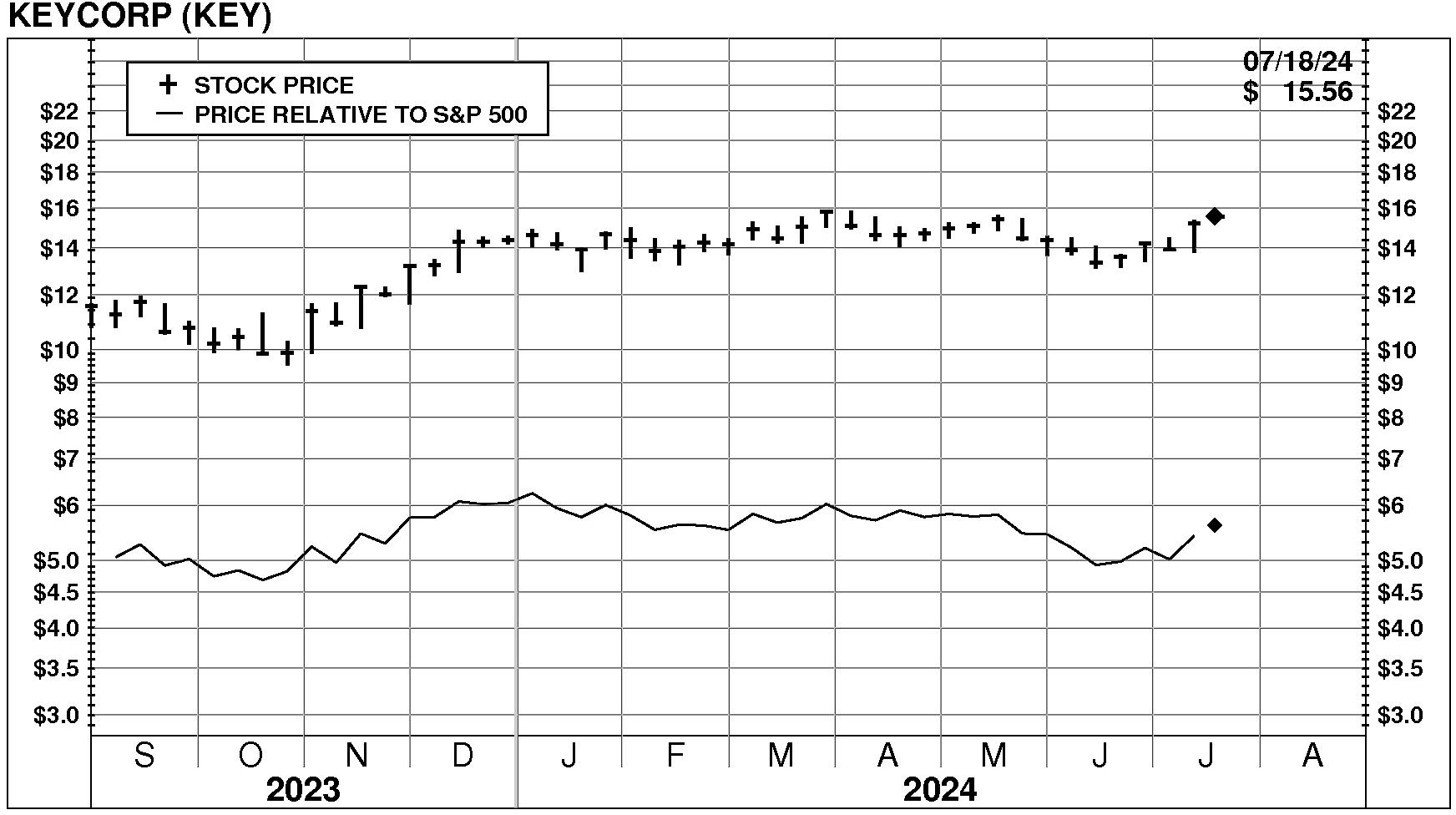

KeyCorp (NYSE: KEY) stock declined by -4.0% on 7/18/24. The shares closed at $15.56. Moreover, exceptionally high trading volume at 239% of normal accompanied the decline. The stock has been strong relative to the market over the last nine months and has risen 6.1% during the last week.

Current PriceTarget Research Rating

With future capital returns forecasted to exceed the cost of capital, KEY is expected to continue to be an important Value Builder.

KeyCorp has a current Value Trend Rating of A (Highest Rating). The Value Trend Rating reflects complementary signals from PTR’s two proprietary measures of a stock’s attractiveness. KeyCorp has a slightly positive Power Rating of 70 and a very high Appreciation Score of 87, resulting in the Highest Value Trend Rating.

Rating Review

In light of this new information we are reviewing our current Overall Rating of A. This review will be completed in the next several days.

Be the first to comment