Recent notable negative changes in fundamentals have affected Cheniere Energy Inc. (NYSE: LNG): significant quarterly sales deceleration occurred, significant quarterly earnings deceleration occurred, and the consensus estimate for December, 2025 decreased significantly.

Important negative changes in Cheniere Energy Inc. (NYSE: LNG) investment behavior have recently occurred: its shorter term price trend turned down.

In light of these highly negative signals we are reviewing our current Overall Rating of D. We would continue to view the shares with caution pending completion of this review in the next several days.

Current PriceTarget Research Rating

LNG is expected to continue to be a major Value Builder reflecting capital returns that are forecasted to be above the cost of capital.

Cheniere Energy has a current Value Trend Rating of D (Negative). With this rating, PTR’s two proprietary measures of a stock’s current attractiveness are providing highly consistent signals. Cheniere Energy has a slightly negative Appreciation Score of 39 and a slightly negative Power Rating of 37, with the Negative Value Trend Rating the result.

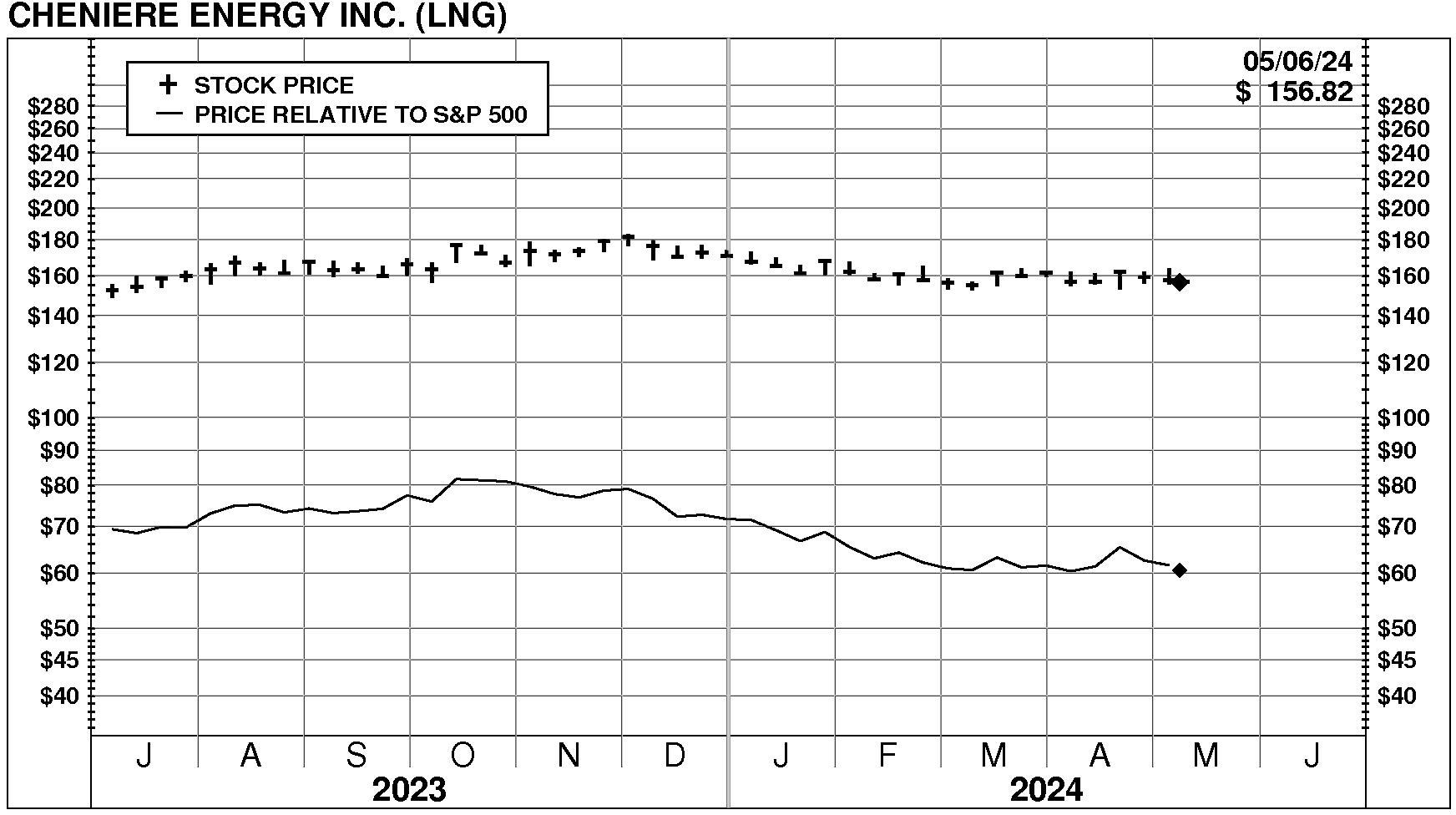

Recent Price Action

Cheniere Energy Inc. (NYSE: LNG) stock declined slightly by -0.5% on 5/6/24. The stock closed at $156.82. Moreover, trading volume in this decline was above average at 134% of normal. The stock has been weak relative to the market over the last nine months and has declined -1.5% during the last week.

Be the first to comment