For its first fiscal quarter (ending March 31), Southwestern Energy Co (NYSE: SWN) has reported a -179% decline in E.P.S. from $1.76 a year ago to $-1.39 in the current quarter. This result fell short of the consensus estimate of $0.32 by $-1.71. For the latest four quarters through March 31, E.P.S. were $-1.74 versus $5.85 for the same period a year ago — a decline of -130%.

Recent Price Action

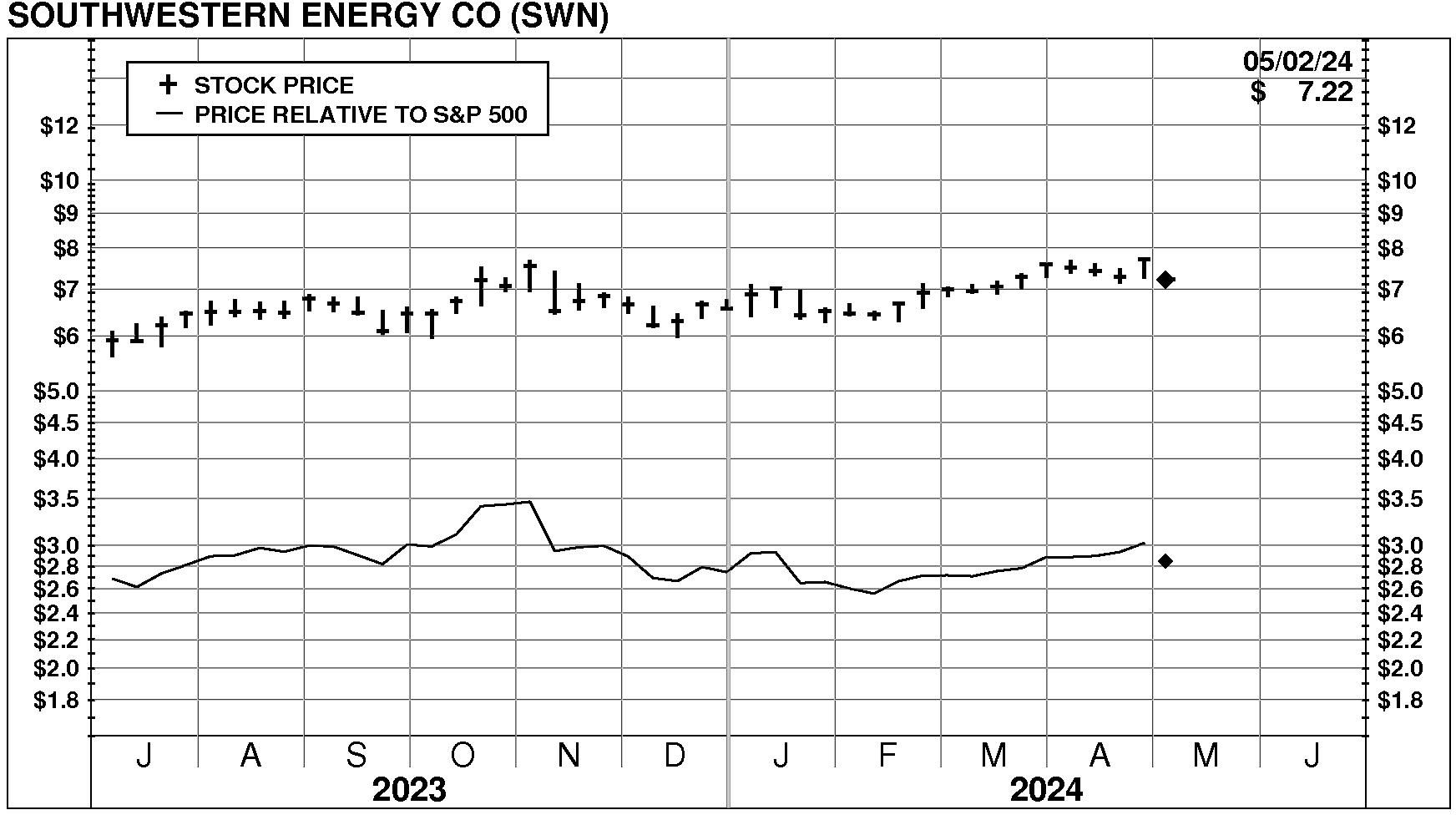

On 5/2/24, Southwestern Energy Co (NYSE: SWN) stock was unchanged 0.0%, closing at $7.22. Moreover, unusually high trading volume at 150% of normal accompanied the flat performance. Relative to the market the stock has been strong over the last nine months but has declined -4.9% during the last week.

Current PriceTarget Research Rating

With future capital returns forecasted to be above the cost of capital, SWN is expected to continue to be a major Value Builder.

Southwestern Energy has a current Value Trend Rating of C (High Neutral). The Value Trend Rating reflects inconsistent signals from PTR's two proprietary measures of a stock's attractiveness. Southwestern Energy has a good Appreciation Score of 75 but a neutral Power Rating of 47, triggering the High Neutral Value Trend Rating.

Rating Review

In light of this new information we are reviewing our current Overall Rating of C. This review will be completed in the next several days.