Stock Rating Downgrade

During the last several trading days the Value Trend Rating for Flex Ltd (NASDAQ: FLEX) weakened from B to C reflecting eroding fundamentals and low Appreciation Potential.

Recent Price Action

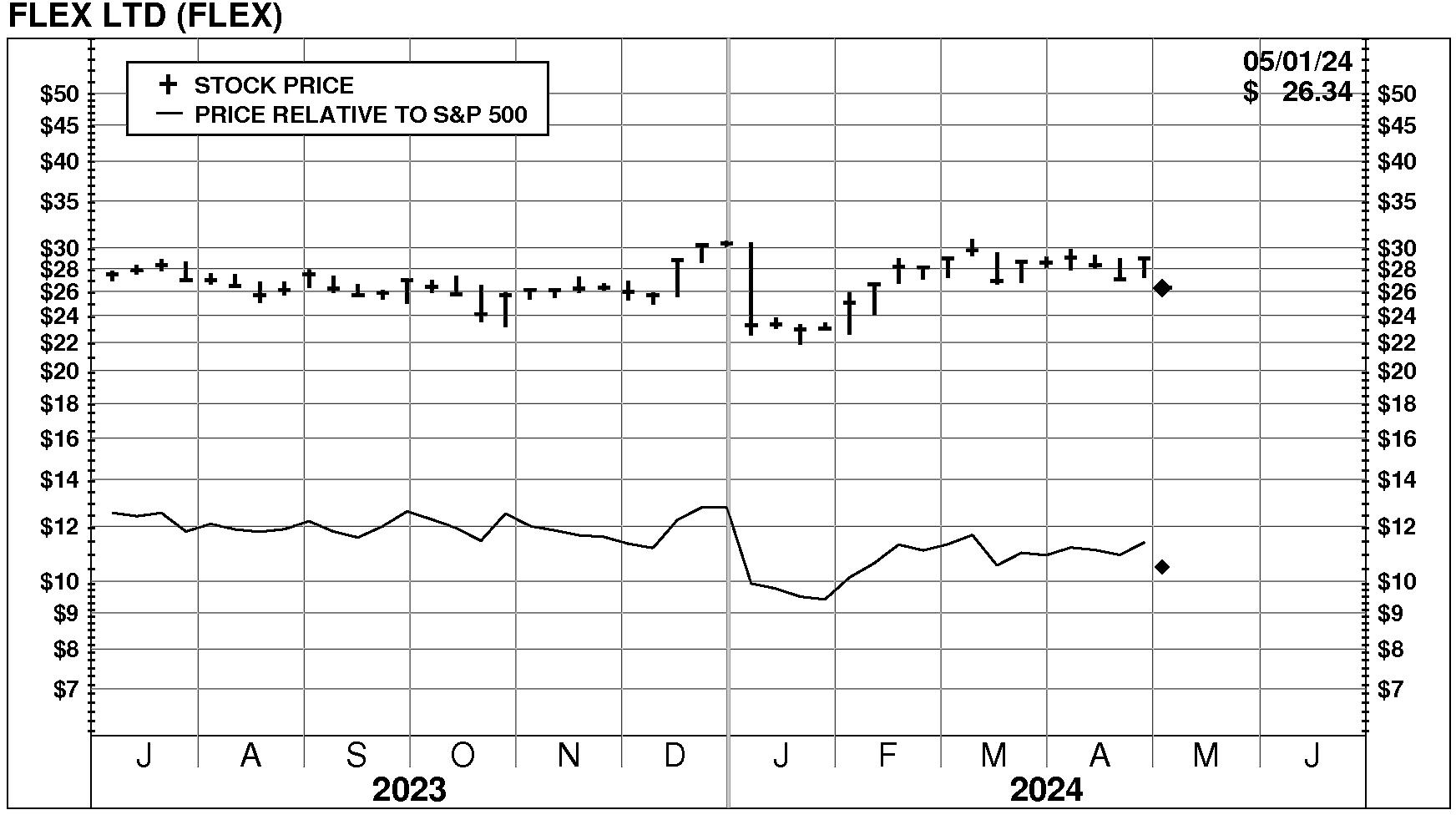

Flex Ltd (NASDAQ: FLEX) stock suffered a large decline of -8.1% on 5/1/24. The stock closed at $26.34. Moreover, this decline was accompanied by exceptionally high trading volume at 322% of normal. The stock has performed in line with the market over the last nine months and has declined -7.7% during the last week.

Current PriceTarget Research Rating

FLEX is expected to continue to be an important Value Builder reflecting capital returns that are forecasted to exceed the cost of capital.

Flex has a current Value Trend Rating of C (High Neutral). With this rating, PTR’s two proprietary measures of a stock’s current attractiveness are providing inconsistent signals. Flex has a neutral Power Rating of 53 but a good Appreciation Score of 71, and the High Neutral Value Trend Rating results.

Be the first to comment